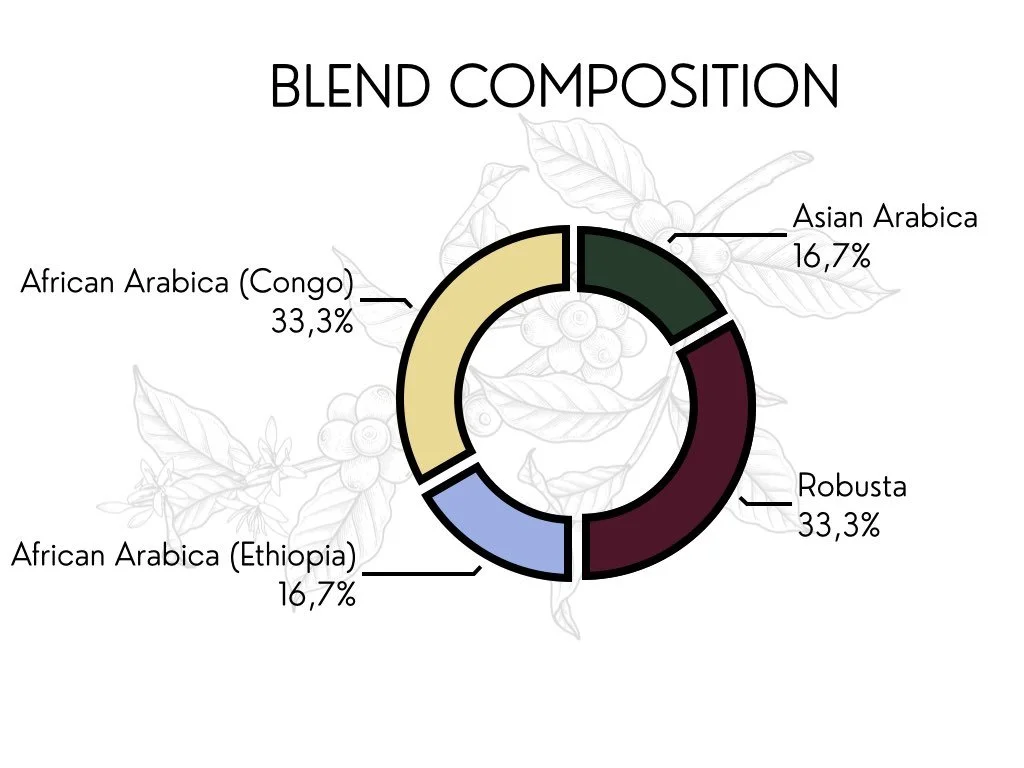

2026 BLEND

AFRICAN COMPONENT - CONGO/ETHIOPIA

FARMS: Limmu Kossa Family Estate, RAEK Cooperative (Around 900 farmers)

LOCATION: Jimma, Ethiopia, Katana,South Kivu, DRC

CULTIVARS:

For Ethiopia Local varieties selected on productivity, strength and micro-region fit, called: 74165, 75227, 74140, 74110, 74112 and 5227

For Congo : Arabica JBM (a type of Typica) and Bourbon (Jackson)

EXPORTER: ABA OLLY, RAEK

IMPORTER: This Side Up Coffees

ROASTER: Zwarts Coffee (Amsterdam Roasters)

OPERATOR: Selecta Netherlands

ASIAN COMPONENT - INDONESIAN ARABICA

BOERDERIJEN: 250 boeren leveren aan de Kojoyo-coöperatie.

LOCATIE: Java, Indonesië

CULTIVARS: Kartika 30%, Lini S 50%, Sigararutang 10%

EXPORTEUR: Ontosoroh

IMPORTEUR: This Side Up Coffees

BRANDER: Roast Factory

OPERATOR: Selecta Nederland

JAVA SINDORO - KOJOYO COOPERATIVE

De Kojoyo Cooperative, onder leiding van Wahyu Setiono, brengt meer dan 250 Arabica-koffietelers uit zes districten in Temanggung, Midden-Java, samen, waarvan er vier zich richten op Arabica van speciale kwaliteit. Kojoyo werd in 2019 opgericht en is ontstaan uit Wahyu's transitie van afgestudeerd theoloog en koffiehandelaar naar innovator op het gebied van verwerking.

Nadat hij de kunst en wetenschap van koffieverwerking had ontdekt, volgde Wahyu een opleiding aan de Java Legend Coffee School, waar hij zowel basis- als geavanceerde verwerkingstechnieken onder de knie kreeg. Zijn doel was duidelijk: economische kansen creëren voor kleine boeren en hen tegelijkertijd begeleiden naar duurzame en speciale koffieproductie. De coöperatie werkt ook samen met het Indonesische Nationale Agentschap voor Terrorismebestrijding (BNPT) om voormalige extremisten te rehabiliteren door middel van koffieteelt en toerisme. Verschillende leden zijn ex-gedetineerden die nu hun brood verdienen met koffie.

Kojoyo, gelegen in een regio die vroeger afhankelijk was van tabaksteelt, speelt een cruciale rol bij het helpen van boeren bij de overgang van tabak naar koffie, het verjongen van de bodem door middel van biologische landbouw en het bevorderen van klimaatbestendigheid met windschermen, compostering en initiatieven voor bodemregeneratie. Ondanks uitdagingen zoals cyclonen en onvoorspelbaar weer, blijven Wahyu's gestructureerde aanpak en zijn inzet voor empowerment van de lokale bevolking zowel het land als de gemeenschap versterken..

JAVA CANDIROTO - KOJOYO COOPERATIVE

Cahyo, founder of First Light coffee. Cahyo Pertama, whose name literally translates to First light is a 31 year old entrepreneur that is leading the youth movement from Candiroto village in the Temanggung district. Coffee has been part of his family although his parents have been spice traders all their life. Originally this village used to have excelsa variety that never really made the cut making robusta this region’s native species. Although coffee wouldn’t be the first choice for many of the youth that are part of his group, finding jobs that could pay bills was getting difficult. More of younger members came together to discuss this and see how they could help themselves find stable alternatives. Since most of them had coffee in their family and it was evident demand for higher quality coffee seemed promising. 20 of them together with Cahyo decided to give specialty coffee a try out of which roughly 10 of them were first time coffee planters. Incomes from coffee allowed them to also improve their ‘image’ in the society, it was profitable and doing it together enabled access to knowledge, resources easily. It is a robusta that clearly can change the bad reputation this variety has.

Limu Kossa was founded by Giday Berhe. He began his coffee career as a trader in Jimma in 1993. He then opened a wet and dry milling station with the aim of supplying the central coffee market with high-quality coffee. In the early 2000s, he decided to establish his own farm in the village of Galeh in Jimma and, from the outset, build meaningful relationships with neighboring small producers. Not only does he spend a large part of his profits on healthcare and education for the community, he also actively teaches farmers to upgrade their farms and techniques so that they can ultimately process and export their coffee at high premiums. His dedication to producing quality coffee while supporting his local community has even earned him the title ‘Abba Ollie’ or ‘he who uplifts’.

RAEK itself was founded in 1996 to offer an economic alternative and reliable income source for vulnerable members, including women and youth, in a region severely impacted by poverty and conflict. RAEK's coffee is grown at high altitudes (1,400 to 1,800m) around the Kahuzi Biega National Park and is known for its high quality (scoring over 85.5%) and Certified Organic status. TSU has maintained a vital partnership with the RAEK cooperative (Regroupement des Agriculteurs et Eleveurs de Kabare) since 2017, consistently purchasing their coffee to offer essential economic stability and support development in their war-affected region of South Kivu, DRC.

The planned import of the 2024 harvest, originally expected in early 2025, was significantly delayed until recently (late 2025) due to severe geopolitical complications that saw both the RAEK partners and the coffees themselves scathed by the conflict.

This challenging situation creates a timely opportunity to rewrite the Radboud Blend starting in 2026, allowing for the direct inclusion of this Congolese coffee. By committing to this sourcing, Radboud can have a direct, tangible impact on the well-being of the farmers, as providing this kind of reliable economic stability during intense conflict is a crucial factor in helping the community maintain cohesion and protect biodiversity by offering an alternative to poaching.

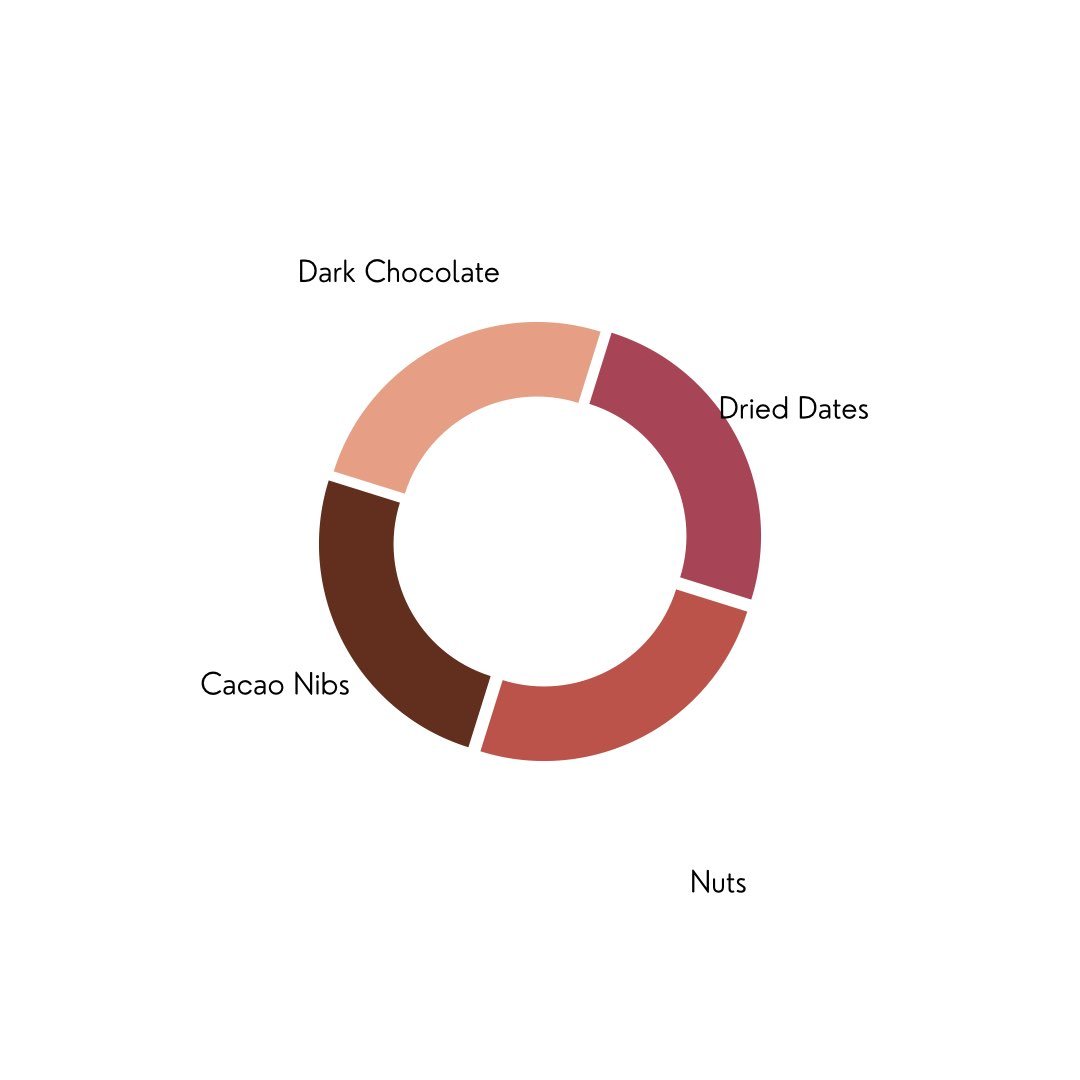

Aroma: maple syrup, nutty, chocolate

Flavour: cacao nibs. dried dates ,lingering after taste of dark chocolate

Acidity : Mild soft acidity

Body : Full rounded body

Ethiopia: Fully washed, with cherries hand-picked, pre-sorted, floated, pulped, wet-fermented for 12 hours, soaked, washed, dried on raised beds, and dry-milled under the supervision of the farm owner, Giday. Congo: Fully washed, involving 12 hours of wet fermentation, washing with mountain water, shade drying and pre-sorting, followed by sun-drying on raised beds. Indonesia: For Robusta : only the ripest red cherries are picked, submerged to remove floaters, pulped, and fermented in anaerobic tanks for 5 days — dry fermentation for Tugusari and submerged fermentation for BP — before open-air drying on raised beds for 15 days, one-month resting, hulling, and final sorting, while wet-hulled lots follow the traditional giling basah method of pulping, brief fermentation, partial drying, hulling at high moisture, and final drying. This combination makes the blend’s flavours pop by layering Ethiopia’s bright, delicate aromatics with Congo’s structured sweetness and Indonesia’s bold, creamy depth, creating a cup where clarity, body, and sweetness amplify each other rather than compete.

-

2023 HARVEST

We imported a “community lot” of a smallholder farmer, via the export license of the Sheka Estate. The price we paid was $2.50 per lb, which translates to $5.50/kg which against the exchange rate of that moment landed at €5.30 per kg.

2025 Harvest

We are using Grade 1 washed - the highest quality from one of long term partners at Ethiopia in Jimma for this blend to enhance the quality. We paid $8,80 at FOB for these coffees.

-

2022/2023 HARVEST

The ASNIKOM farmers got prefinanced by the Dutch NGO Progreso Foundation. Contract was made in euros, at €4.77/kg for the farmers. Here, there was an additional fee for Ontosoroh Coffee, to export the products, as is shown in the second contract, which is Rp7,200 per kg, which is €0.47 per kg. This brings the total to €5.25 per kg.

The Temanggung Candiroto farmers received €3.81/kg and the Ontosoroh Coffee export costs and fee were €0.79 per kg. This brings the total to €4.60 per kg.

2023/2024 HARVEST

Candiroto farmers received a farm gate price of €4.23 per kg and including the export fees, the price landed at €4.80 per kg FOB.

2025/2026 Harvest

This is the first year that we will be supplying Indonesian coffee to offices in South Holland. The contract price for Java Sindoro - Wet Hulled was set at €5.62 per kilogram FOB.

This is the first year that we will be supplying Indonesian coffee to offices in South Holland. The contract price for Java Candiroto - Pulped Natural was set at €4.95 per kilogram FOB.

-

2024-2025

This harvest was delayed due to the geopolitcal war at Congo. The coffees used for this blend were Grade 4 blend from farmers who supply to Cooperative.The coffees were priced based on the grades and this was $4.81 at FOB

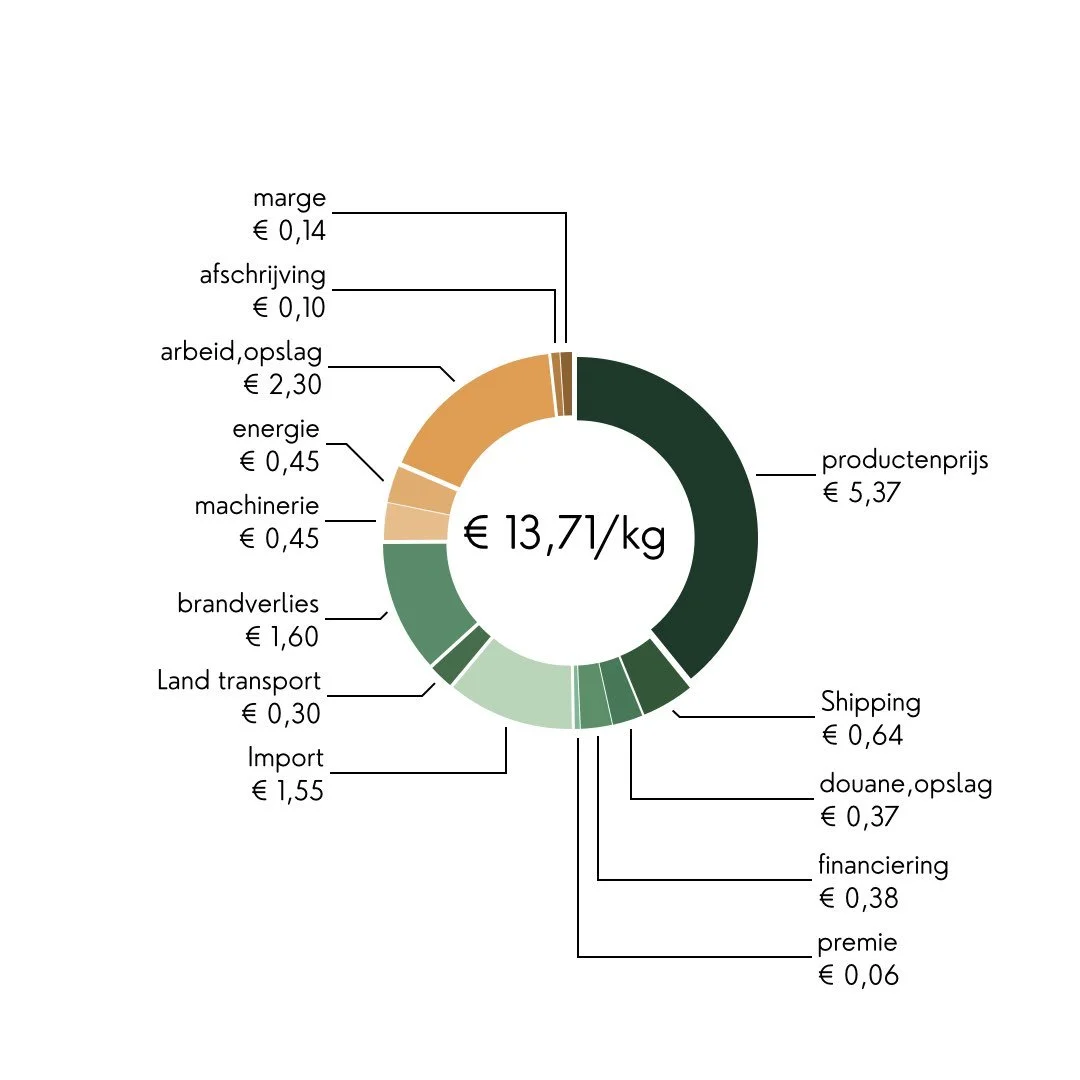

Many parties claim to be sustainable and carry out “impact projects” to mask their negative impact and divert attention. At This Side Up, we pay good prices — and we’re proud of that. So we’re happy to show it. Below you’ll find the purchase contracts we’ve signed with our partners in coffee-producing countries. We work through open dialogue with producers, based on equal entrepreneurship and grounded in their production costs plus a profit margin — and we pay that price. We compare it to both the world market price and the Fairtrade price to illustrate what this means in concrete terms.

Copyright on pictures. Please consult This Side Up Coffees if one desires to use the pictures for commercial and non-commercial purposes.

WHERE: Flores, Indonesia

WHAT: Establishing an agroforestry system to improve coffee yields and provide alternative sources of income for farmers on Flores.

WHO: 100 farmers from Flores, Indonesia, This Side Up, MVO, Asnikom, Pretaterra, CCF, and Progreso.

WHERE: Nicaragua, Peru, Colombia, Brazil, Rwanda, Ethiopia, Uganda, DR Congo, Kenya, Tanzania, Myanmar, India, Sri Lanka, Thailand, and Indonesia.

WHAT: Providing an additional and lasting investment incentive for our partner producers in regenerative agriculture.

WHO: All origin partners of This Side Up.

WHERE: Rende Nao, Manggarai, Flores, Indonesia; Amsterdam, the Netherlands; Barcelona, Spain

WHAT: Creating the very first fashion collection designed at the origin location.

WHO: Sylvia Calvo (Sylvia Calvo BCN), Adri Yahdiyan (Ontosoroh Coffee), This Side Up Coffees.

WHERE: Abakundakawa Rushashi, Gakenke District – Northern Province, Rwanda

WHAT: Creating an agroforestry pilot plot to test and demonstrate the potential of an intercropping system to non-certified coffee farmers.

WHO: Abakundakawa Rushashi (cooperative), This Side Up (funder), MVO Nederland (funder), Matthew Gates (agronomist).

Adri Yahdiyan

adri@ontosoroh.co.id

+62 857 4385 9181

Gidey Berhe Retta

limmukossa1@gmail.com

+251 917 550 244